Our Company

Historical Highlights

2024

Increase ownership in the Caserones mine from 51% to 70%

Joint acquisition of Filo with BHP and partnership to progress the Filo del Sol and Josemaria projects

Announcement of the sale of Neves-Corvo and Zinkgruvan to Boliden

2023

Announce acquisition of the Caserones mine, a long life open pit copper mine in Chile

Head office successfully moves to Vancouver

$206 million paid out in annual dividends to shareholders

Record annual copper production

2021

Achieve best-ever Total Recordable Injury Frequency rate of 0.54

Increase regular quarterly dividend by 125% and pay inaugural performance dividend

Substantially complete Neves-Corvo Zinc Expansion Project to double zinc production capacity

Announce acquisition of Josemaria Resources Ltd. for its large copper-gold project in Argentina

2020

Increase regular quarterly dividend by 33%

Restart construction of Neves-Corvo Zinc Expansion Project after proactive COVID-19 temporary suspension

Complete Candelaira Mill Optimization Project

2019

Acquire long-life expandable copper-gold Chapada Mine in Brazil

Mine first ore from Eagle East ahead of schedule and under budget

Candelaria mine fleet reinvestment complete and deliver first ore from South Sector underground mine

2018

Commission Los Diques tailings storage facility at Candelaria ahead of schedule and under budget

Advance high-return investment projects at Candelaria, Neves-Corvo Zinc Expansion and Eagle East

Complete early retirement of US$1.0 billion of Candelaria acquisition debt

2017

Declare first ever dividend

Commence Neves-Corvo Zinc Expansion Project to double zinc plant capacity

Announce significantly improved life of mine plan for Candelaria Complex and investment initiatives

Complete sale of interest in Tenke Fungurume Mine

2016

Reach agreement for sale of indirect interest in Tenke Fungurume Mine for $1.136 billion

Commence development of Eagle East Project

2015

Discover Eagle East deposit roughly two kilometers from the Eagle Mine

Deliver improved life of mine plan for Candelaria Complex including two new underground orebodies

2014

Acquire 80% interest and operatorship of Candelaria Copper Mining Complex in Chile

Eagle Mine commences production ahead of schedule and under budget

2013

Acquire nickel-copper Eagle Project in Michigan, U.S.A.

Acquire an effective 24% interest in the Kokkola Cobalt Refinery in Finland, providing direct end-market access for cobalt hydroxide production from the Tenke Fungurume Mine

2012

Restart production at Aguablanca Mine

2011

Approve second phase of expansion for the Tenke Fungurume Mine to increase copper production by 50%

2010

Zinkgruvan Mine copper plant commissioned

Discover high-grade Semblana deposit at Neves-Corvo Mine

2009

Tenke Fungurume Mine produces first copper cathode

Commence production from expanded copper plant at Neves-Corvo Mine

2008

Discover new zinc-copper zone at Neves-Corvo Mine and announce expansion of copper plant

2007

Acquire Tenke Mining Corporation – primary asset is the large copper and cobalt Tenke Fungurume Project in DRC

Announce expansion plans to quadruple zinc production at Neves-Corvo Mine and commence copper production at Zinkgruvan Mine

Acquire Rio Narcea Gold Mines, Ltd. – primary asset is the nickel-copper Aguablanca Mine in Spain

2006

Merge with EuroZinc Mining Corporation – principal assets are the copper-zinc Neves-Corvo Mine and zinc Aljustrel Project both in Portugal

2005

Merger with Arcon International Resources P.L.C. – main asset is the zinc-lead Galmoy Mine in Ireland

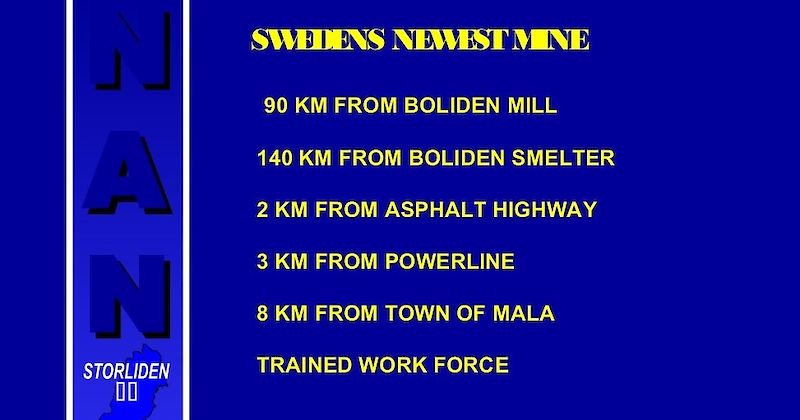

Acquire outstanding ownership of North Atlantic Natural Resources AB – main asset is the zinc-copper Storliden Mine in Sweden

2004

Acquire the zinc-lead-silver Zinkgruvan Mine in Sweden

Company name change to Lundin Mining Corporation

Graduation to Toronto Stock Exchange and O-List of Stockholm Stock Exchange

2002

Storliden Mine commences commercial production

2001

North Atlantic Natural Resources and Boliden Mineral AB enter joint venture agreement to develop the Storliden Mine

1997

The company, through its 39% ownership of North Atlantic Natural Resources, discovers the Storliden deposit in northern Sweden

1994

Lundin Mining Corporation is incorporated by registration of its Articles of Incorporation pursuant to the Canada Business Corporations Act under the name “South Atlantic Diamonds Corp.”