Guidance & Outlook

This page contains non-GAAP measures and forward-looking information about expected future events and financial and operating performance of the Company. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

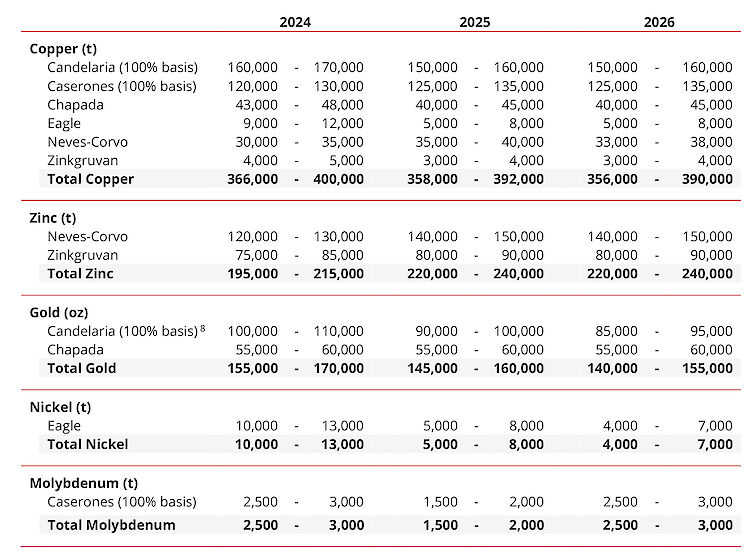

Production Outlook1

2024 Cash Cost Guidance2,3,4,5

Candelaria’s cash cost is expected to approximate $1.60/lb to $1.80/lb of copper, after by-product credits.

Caserones cash cost is forecast to be $2.60/lb – $2.80/lb of copper, after by-product credits.

At Chapada, the cash cost is forecast to be $1.95/lb – $2.15/lb of copper in 2024, after unencumbered gold by-product credits.

Eagle cash cost is forecast to be $2.80/lb – $3.00/lb of nickel in 2024, after by-product copper credits. Neves-Corvo cash cost is forecast to be $1.95/lb – $2.15/lb of copper in 2024, after zinc and lead by-product credits.

Zinkgruvan cash cost is forecast to be $0.45/lb – $0.50/lb of zinc, after copper and lead by-product credits, consistent with 2023 levels.

|

Cash Cost |

2024 |

|||||||||

|

Copper |

||||||||||

|

Candelaria |

$1.60/lb |

- |

$1.80/lb |

|||||||

|

Caserones |

$2.60lb |

- |

$2.80/lb |

|||||||

|

Chapada |

$1.95/lb |

- |

$2.15/lb |

|||||||

|

Neves-Corvo |

$1.95/lb |

- |

$2.15/lb |

|||||||

|

Zinc |

||||||||||

|

Zinkgruvan |

$0.45/lb |

- |

$0.50/lb |

|||||||

|

Nickel |

||||||||||

|

Eagle |

$2.80/lb |

- |

$3.00/lb |

|||||||

2024 Capital Expenditure Guidance2

|

Capital Expenditures ($ millions) |

2024 |

|

|

Sustaining Capital |

||

|

Candelaria (100% basis) |

$300 |

|

|

Caserones (100% basis) |

$205 |

|

|

Chapada |

$110 |

|

|

Eagle |

$25 |

|

|

Neves-Corvo |

$125 |

|

|

Zinkgruvan |

$75 |

|

|

Total Sustaining Capital |

$840 |

|

|

Josemaria Project |

$225 |

|

|

Total Capital Expenditures |

$1,065 |

|

2024 Exploration Expenditure Guidance

Exploration expenditures are planned to be $48 million in 2024 primarily for in-mine and near-mine targets at our operations. The largest portion of the planned expenditure is to be at Caserones (12,900 meters), while at Josemaria, early exploration drilling (5,200 meters) on additional new targets is planned. The focus at Caserones will be deeper in-pit drilling to better define higher grade breccia zones and exploration drilling to test the sulphide mineral potential below the underlying Angelica oxide deposit. At Josemaria the exploration priority will be to test the Cumbre Verde target. At Chapada additional drilling at Sauva will continue to further define higher grade resources. At Zinkgruvan, the exploration campaign (55,000 meters) will target mineral extensions demonstrating grades of 10 - 20% zinc.

1. Production guidance is based on certain estimates and assumptions, including but not limited to: Mineral Resources and Mineral Reserves, geological formations, grade and continuity of deposits and metallurgical characteristics.

2. Cash costs and expansionary capital expenditures are a non-GAAP measure. Please also see the Management’s Discussion and Analysis for the year ended December 31, 2022 and for the three and nine months ended September 30, 2023, for discussion of non-GAAP measures and other performance measures. 2024 cash costs and capital expenditures are based on various assumptions and estimates, including, but not limited to: production volumes, commodity prices (2024 - Cu: $3.75/lb, Zn: $1.10/lb, Pb: $0.90/lb, Mo: $20.00/lb, Au: $1,800/oz: Ag: $23.00/oz) and foreign currency exchange rates (2024 - €/USD:1.05, USD/SEK:10.50, CLP/USD:850, USD/BRL:5.00) and operating costs.

3. 68% of Candelaria’s total gold and silver production are subject to a streaming agreement and as such cash costs are calculated based on receipt of $425/oz and $4.25/oz, respectively, on gold and silver sales in the year. No consideration has been made for the upfront payment received in the calculation of cash costs.

4. Chapada cash costs are calculated on a by-product basis and do not include the effects of copper stream agreements. Effects of copper stream agreements are reflected in copper revenue and will impact realized revenue per pound.

5. Silver production at Zinkgruvan and Neves-Corvo are also subject to streaming agreements.